Discounted future cash flow calculator

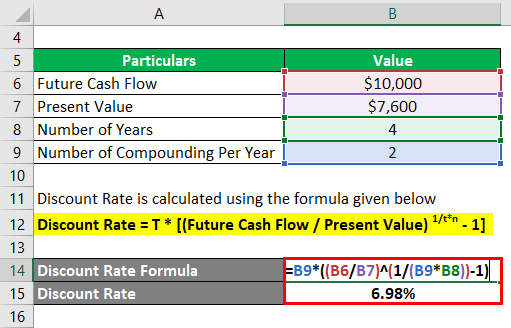

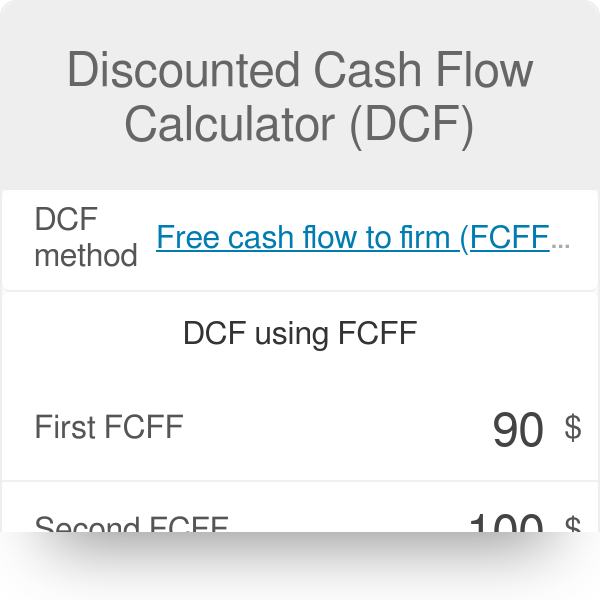

After forecasting the future cash flows and determining the discount rate DCF can be calculated through the formula below. Discounted Cash Flows Calculator This calculator finds the fair value of a stock investment the theoretically correct way as the.

How To Calculate Discounted Cash Flow For Your Small Business

The discounted cash flow formula to calculate growth value terminal value and Intrinsic value is as follows.

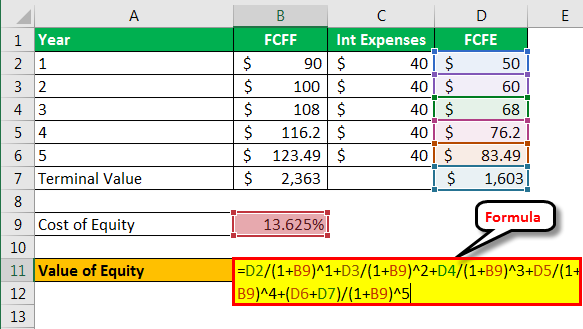

. This is the value of all of your future cash flows discounted in todays dollars at your Weighted Average Cost of Capital WACC. DCF Calculator for Stocks DCF analysis is a method of valuing a company using the concepts of the time value of money. Conversely if you wanted to know how much you would need to deposit today for your investment to grow to 110 in 1 year you would discount the future value by dividing it by 1 plus the rate.

The discounted cash flow DCF formula is. Users can see the accurate value of the intrinsic value growth value and terminal value. DCF CALC BEFORE You calculate.

And also can see the intrinsic value in. Expected annual growth This is the rate you expect your. Discounted Cash Flows Discounted cash flow DCF is a valuation method used to estimate the value of an investment based on its future cash flows.

CFn 1r 1 1r 2 1r n The discounted cash flow formula uses a cash flow forecast for future years discounted back to. The discounted cash flow calculation can be straightforward or complicated depending on the elements it contains. All future cash flows are estimated and discounted by using the cost of capital to give their present values.

The discounted cash flow calculator calculates the weighted average cost of capital WACC taking into account the financial leverage of the business the cost of equity and debt. GARBAGE IN GARBAGE OUT. Three steps in startup valuation with Discounted Cash Flows.

All future cash flows are estimated and. DCF analysis attempts to figure out the value of an investment today based on projections of how much money it will. Now that we have growth and discount rates we can calculate all future cash flows.

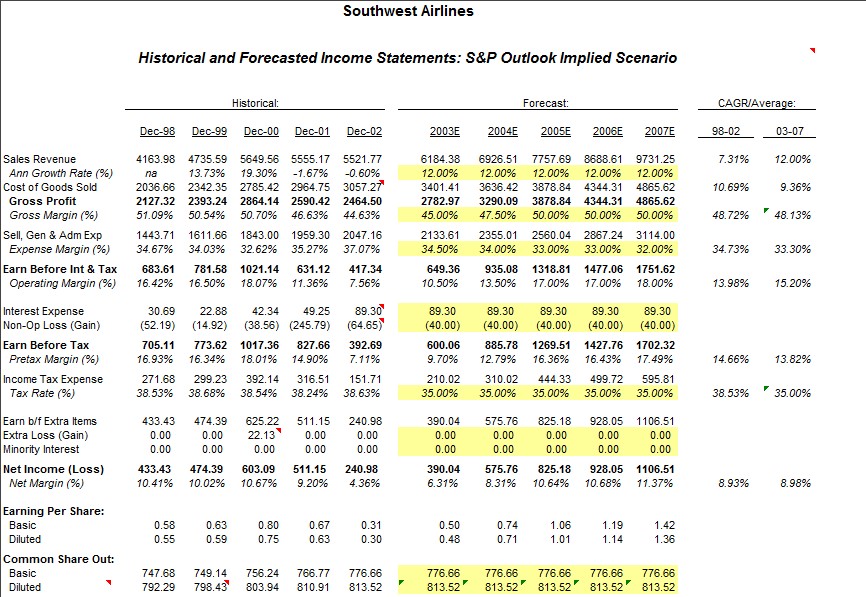

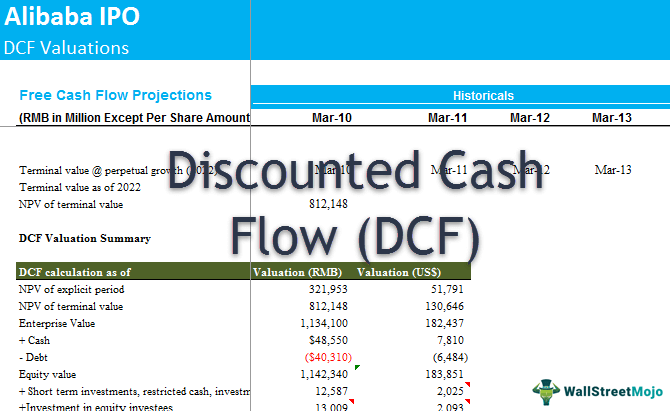

Discounted Cash-flow Model is a quantitative method that calculates a companys stock price based on the sum of all future free cash flow earned from that company at a discount rate. Cash flows for the next 7. Calculation of Discounted Cash Flow DCF DCF analysis takes into consideration the time value of money in a compounding setting.

However either way its always based on the following discounted cash. Simple Our easy to use interface provides sensible defaults. Initial FCF Rs Cr Take 3 Years average.

A Simple Ten-Year Discounted Cash Flow DCF Calculator By Stock Research Pro April 10th 2011 Discounted Cash Flow or DCF is a process for measuring the value of a stock or. Coefficient A 1 g 1 r. It helps to calculate the actual value of the asset or company and helps to project your future profit earnings.

Discounted Cash Flow Calculator for Stock Valuation DCF. DCF Calculator DCFTool Perform a Discounted Cash Flow analysis with live data. To do this we need to split the future cash flows into two portions.

DCF CF1 CF2. What is Discounted Cash Flow analysis. The CF n value should include both the estimated cash flow of that period and the terminal.

Heres our Discounted Cash Flow DCF Calculator for your ease of calculation so that you dont have to break your head in complicated excel sheets.

Discount Rate Formula How To Calculate Discount Rate With Examples

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Discounted Cash Flow Model Formula Example Interpretation Efm

Discounted Cash Flow Analysis Street Of Walls

Discounted Cash Flow Calculator Dcf

Discounted Cash Flow Create Dcf Valuation Model 7 Steps

Discounted Cash Flow Analysis Study Com

The Discounted Cash Flow Dcf Valuation Method Magnimetrics

Discounted Cash Flow Dcf Explained With Formula And Examples

Discount Rate Formula How To Calculate Discount Rate With Examples

Cash Flow Valuation Part 4 Of How To Value A Small Business Genesis Law Firm

How To Use Discounted Cash Flow Time Value Of Money Concepts

Present Value Of Cash Flows Calculator

Excel Discount Rate Formula Calculation And Examples

Dcf Formula Calculate Fair Value Using Discounted Cash Flow Formula

Discounted Cash Flow Calculator Calculate Dcf Of A Stock Business Investment

Discounted Cash Flow Dcf Formula Calculate Npv Cfi