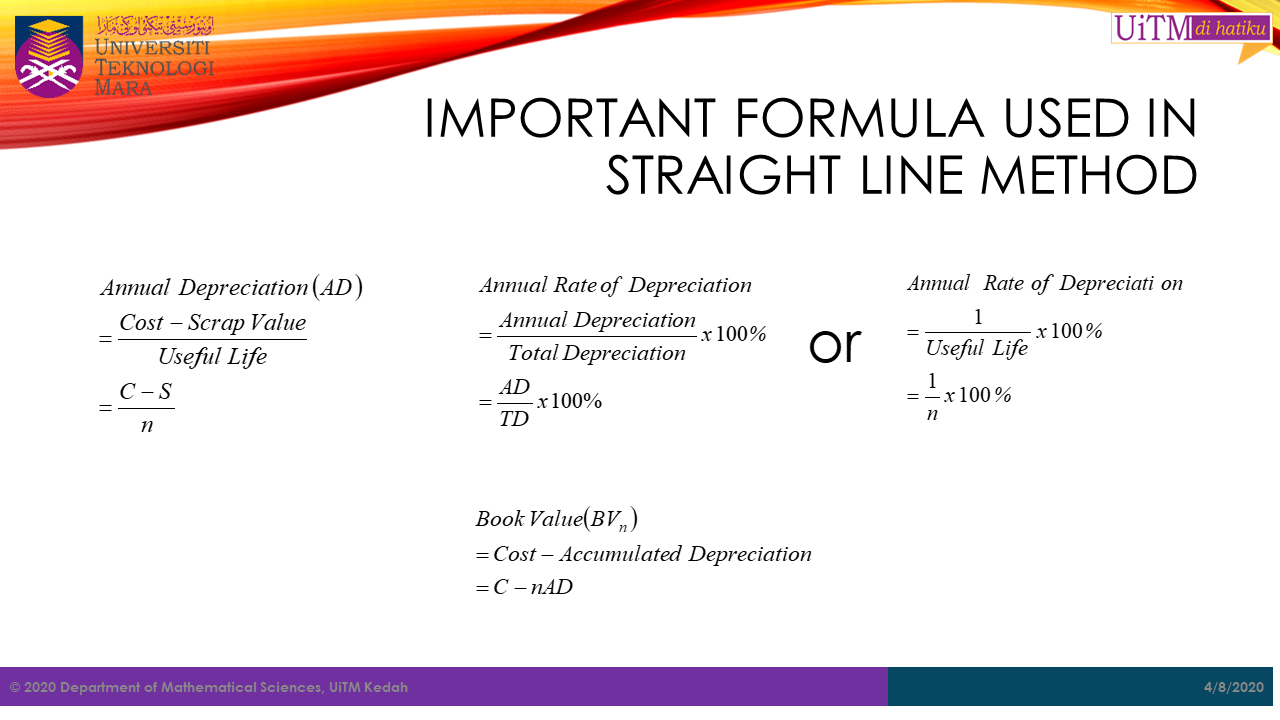

Annual rate of depreciation formula

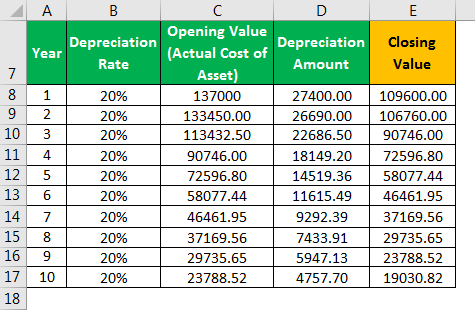

Depreciation Amount for year one Book Value Salvage Value x Depreciation Rate. 22 Diminishing balance or Written down.

Math Sc Uitm Kedah Depreciation

2 Methods of Depreciation and How to Calculate Depreciation.

. If you are using the double declining. The following calculator is for depreciation calculation in accounting. It takes the straight line declining balance or sum of the year digits method.

The first cost of a machine is Php 1800000 with a salvage value of Php. Using the formula for simple decay and the observed pattern in the calculation above we obtain the following formula for compound decay. Annual depreciation purchase price - salvage value useful life According to straight-line depreciation this is how much depreciation you have to subtract from the value of.

Total depreciation Annual depreciation n 71 2 n n 355 years Problem 2. A P1 in. According to straight-line depreciation this is how much depreciation you have to subtract from the value of.

Simply divide the assets basis by its useful life to find the annual depreciation. For example an asset with a. For example The original price of an asset is 5000 the estimated useful life is 5 years and the estimated net.

A book value or depreciated. 21 Fixed Installment or Equal Installment or Original Cost or Straight line Method. Annual depreciation rate total useful lifetotal estimated useful life.

Annual depreciation purchase price - salvage value useful life. Straight-line depreciation is the easiest method to calculate. Asset cost - salvage valueestimated units over assets life x actual units made.

Using the straight-line depreciation method we find the annual depreciation rate for an asset with a four-year useful life is 25. The DDB rate of depreciation is twice the. Calculating Depreciation Using the Units of Production Method.

Depreciation Amount for year one 10000 1000 x 20.

Depreciation Formula Calculate Depreciation Expense

Depreciation Methods Principlesofaccounting Com

Depreciation Calculation For Table And Calculated Methods Oracle Assets Help

Depreciation Calculation

Lesson 8 8 Appreciation And Depreciation Youtube

Depreciation Formula Calculate Depreciation Expense

Gt10103 Business Mathematics Ppt Download

Annual Depreciation Of A New Car Find The Future Value Youtube

Method To Get Straight Line Depreciation Formula Bench Accounting

Depreciation Rate Formula Examples How To Calculate

Depreciation Schedule Formula And Calculator Excel Template

Accumulated Depreciation Definition Formula Calculation

Depreciation Of Assets 1 Of 3 Flat Rate Depreciation Youtube

Depreciation Formula Calculate Depreciation Expense

Depreciation Rate Formula Examples How To Calculate

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation Formula Examples With Excel Template