Heloc loan estimate

The first column can be thought of as a fixed-rate home equity loan or the repayment period of a HELOC if it uses a fixed interest rate during the repayment term. The above amortizaiton tables show the interest costs and payments over a 15-year timeframe for a loan or line of credit that is fully used up to the credit limit.

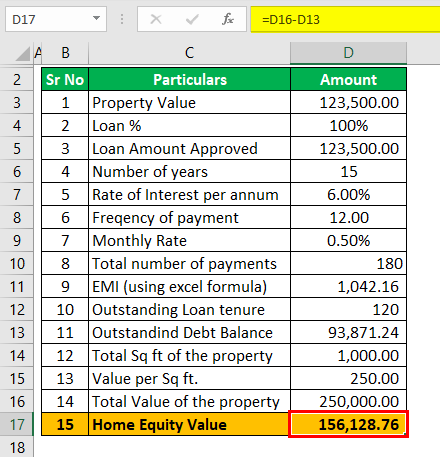

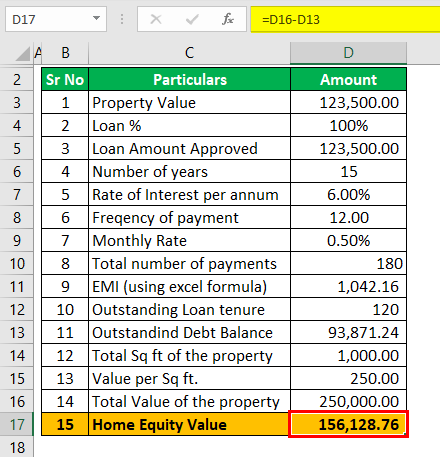

Home Equity Calculator Free Home Equity Loan Calculator For Excel

LENDER APR LOAN AMOUNT RANGE LOAN TERMS MAX LTV.

. You want a credit line available for future emergencies but. If your home is worth 100000 and you owe 40000 on your mortgage then your CLTV is 40. You need a revolving credit line to borrow from and pay down variable expenses.

HELOC Payments How are HELOC repayments structured. Say you take out a 20000 loan and qualify for the average personal loan interest rate. In addition to the interest rate and monthly payment compare the annual percentage rate APR length of the loan total interest paid and loan fees.

The calculator will give your current loan-to-value ratio the percentage of your homes value that you owe to your mortgage lender and whether you might qualify for a HELOC or need to. Consolidating multiple debts means you will have a single payment monthly but it may not reduce or pay your debt off sooner. If you chose a three-year term instead with the same interest rate youd have a higher monthly payment of 692 with a total repayment cost of 24916 so while youd pay more each month youd save 3556 in the long run.

The draw period is the phase. Include the rate of interest any additional equity you would like to withdraw as a cash payment the closing costs associated with the loan and the length of the loan term. The results will compare your new home equity loan payments to the monthly cost of the old debts the effective interest rate and the total monthly payment on those debts.

By extending the loan term you may pay more in interest over the life of the loan. The personal loan calculator lets you estimate your. If you estimate your homes value at 300000 and you have a mortgage loan for 200000 you have 100000 in equity.

Lender APR Introductory APR Line Amount Range HELOC Terms Max LTV. If youre not sure how much youre eligible for use our home equity loan and HELOC amount calculator first. The monthly payment reflects both the repayment for the cash out at closing and your monthly mortgage payment.

The HELOC repayment is structured in two phases. Maximum loan amount for primary residences is 1000000. Maximum loan amount for secondvacation homes is 500000.

A HELOC is a home equity loan that works more like a credit card. A home equity loan make sure you understand the total package of fees that you would have to pay. For line amounts greater than 100000 maximum combined loan-to-value ratios are lower and certain restrictions apply.

How it works. If your lender will lend you 80 of your equity youll be able to borrow. The loan is a lump sum and the HELOC is used as needed.

Enter your loan amount. A HELOC home equity loan will give you the most favorable monthly payment terms due to the length of the loan available. Upwards of 30 -45 days.

This is the amount you want to borrow. The amount you qualify for is based upon the amount of equity available in your home. Before you decide on a HELOC vs.

After comparing loans consider. Loan 1 Loan 2 Loan 3. In that case you most likely wouldnt qualify for a home equity loan or HELOC.

Home equity loans typically range from 5 to 15 years. 15000 to 750000 up to 1 million for properties in California. It allows home owners to borrow against.

A HELOC is a line of credit borrowed against the available equity of your home. You may convert a withdrawal from your home equity line of credit HELOC account into a Fixed-Rate Loan Option resulting in fixed monthly payments at a fixed interest rate. With so many ways to tailor your loan to.

Each lender you apply to will provide a loan estimate. Loan amounts range from 25000 to 150000 with terms of five to 20 years. A home-equity loan also known as an equity loan a home-equity installment loan or a second mortgage is a type of consumer debt.

Your HELOC limit can be determined using the loan to value LTV ratio and remaining mortgage balance. CLTV is your overall mortgage loan debt expressed as a percentage of your homes fair market value. If you want to have the flexibility to tap into your home equity multiple times on an ongoing basis for recurring needs then a HELOC.

You are given a line of credit that can be reused as you repay the loan. Review and compare the loans to determine which lender has the best terms. Depending on your financial goals a home equity loan might be a better fit.

The minimum HELOC amount that can be converted at account opening into a Fixed-Rate Loan Option is 5000 and the maximum amount. Why BMO Harris Bank is the best home equity loan for different loan options. For lines up to 100000 we will lend up to 80 of the total equity in your home.

When you get a HELOC through Prosper your mortgage and HELOC combined can be. The payment reduction may come from a lower interest rate a longer loan term or a combination of both. A home equity line of credit or HELOC could help you achieve your life priorities.

Fixed-Rate Loan Option at account opening. Enter your loan term. This is the annual interest rate youll pay on the loan.

If you are applying for a HELOC a manufactured housing loan that is not secured by real estate or a loan through certain types of homebuyer assistance programs you will not receive a GFE or a. A Smart Refinance loan is a no-closing-cost mortgage refinance option that lets you take advantage of lower rates get cash out at closing and change your loan term to 5 10 15 or 20 years. A home equity line of credit HELOC allows homeowners to borrow funds based on the equity they own in the home.

While a HELOC offers the most favorable terms typically they take the longest for approval. Enter your loans interest rate. For those loans you will receive two forms a Good Faith Estimate GFE and an initial Truth-in-Lending disclosure instead of a Loan Estimate.

Pros and Cons Home equity loans and lines of credit extract value from your home. If however you only owed 200000 on your mortgage you would have 100000 or 33 in equity and most likely. 15000 750000 up to 1 million for properties in California Up to 30 years.

A HELOC is a better option than a home equity loan if. At Bank of America we want to help you understand how you might put a HELOC to work for you.

The Difference Between A Home Equity Loan And A Home Equity Line Of Credit Palisades Credit Union

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Line Of Credit Qualification Calculator

Mortgage Payoff Calculator With Line Of Credit

Home Equity Line Of Credit Heloc Rocket Mortgage

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Home Equity Loan Or Line Of Credit Which Is Right For You Dupaco

Home Equity Loan Rates Calculator Deals 54 Off Www Ingeniovirtual Com

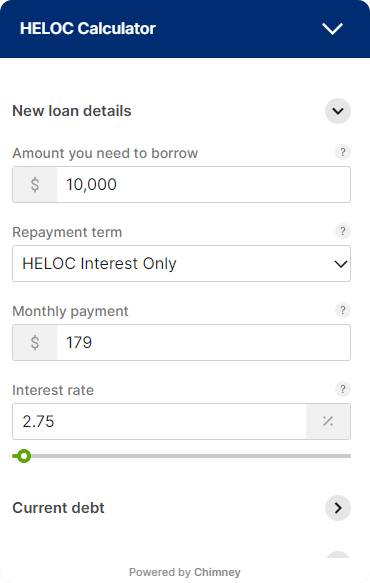

Heloc Payment Calculator With Interest Only And Pi Calculations

Home Equity Loan Calculator By Creditunionsonline Com Calculate Home Equity Loan Payments

Looking For A Heloc Calculator

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

Home Equity Loan Rates Calculator Deals 54 Off Www Ingeniovirtual Com

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Loan Rates Calculator Deals 54 Off Www Ingeniovirtual Com

Home Equity Loans Selco

Heloc Calculator